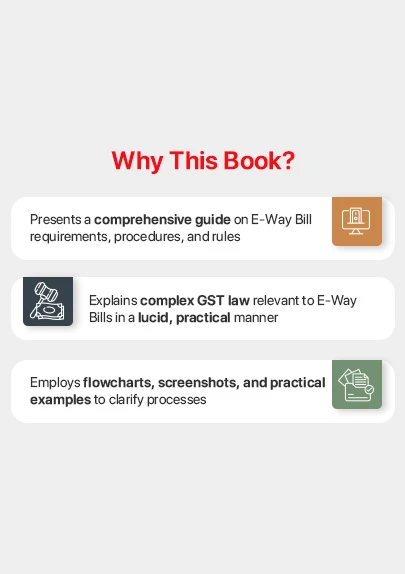

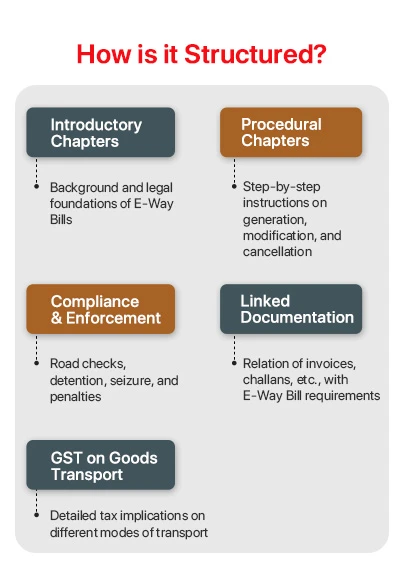

This Book offers a comprehensive guide on the legal and practical aspects of India's E-Way Bill system under the Goods and Services Tax (GST) regime. It thoroughly explains the requirements, procedures, and rules for generating and managing E-Way Bills, including critical updates. It incorporates practical examples and lucid explanations and simplifies the intricacies of GST law as applicable to E-Way Bills, making it an indispensable resource for anyone involved in the movement, supply, and transportation of goods.

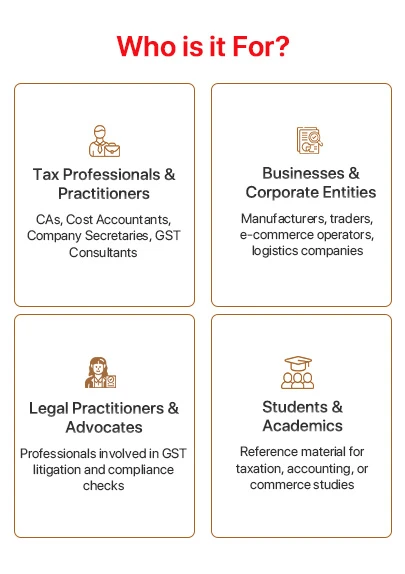

This book is intended for the following audience:

- Tax Professionals & Practitioners – Chartered Accountants, Cost Accountants, Company Secretaries, and GST consultants seeking authoritative guidance on E-Way Bill procedures

- Businesses & Corporate Entities – Manufacturers, traders, e-commerce operators, and logistics companies involved in intra-state and inter-state transportation of goods

- Legal Practitioners & Advocates – Professionals dealing with GST litigation, compliance checks, and penalty proceedings

- Students & Academics – A valuable reference for those pursuing professional courses or academic research in taxation, accounting, or commerce

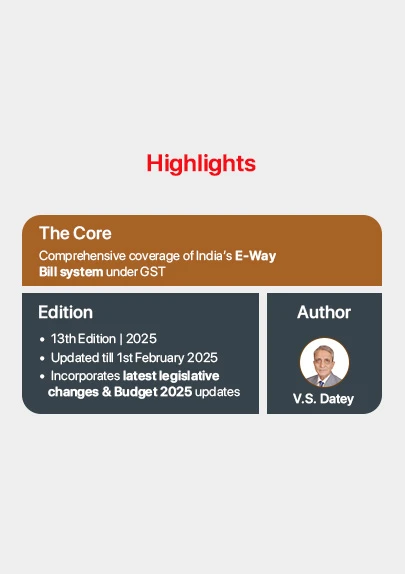

The Present Publication is the 13th Edition | 2025 and has been updated till 1st February 2025. This book is authored by V.S. Datey with the following noteworthy features:

- [Latest Amendments & Notifications] Incorporates the latest legislative changes and clarifications, including Budget 2025 updates

- [Step-by-step Guidance] Offers a practical approach to E-Way Bill generation, validity, and compliance procedures, illustrated with flowcharts, screenshots, and examples

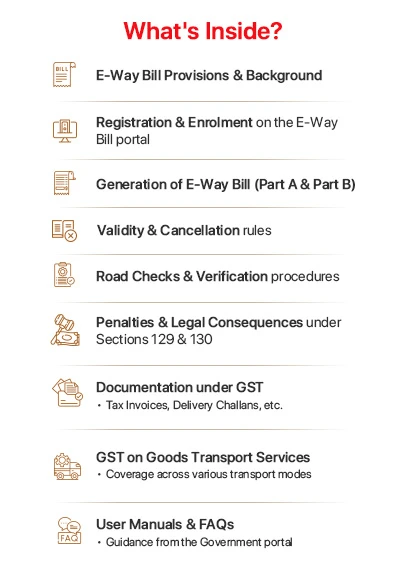

- [Procedural Clarity] Covers the entire lifecycle of an E-Way Bill—from registration on the portal to extensions, cancellations, road checks, and verifications

-

No review given yet!